1. The Money with Katie Show

Investment Expertise You Can Trust

2. So Money

Elegant Solutions for Intelligent Investors

3. Planet Money

Elevating Your Wealth with Classy Investments

4. Money for the Rest of Us

Finance Made Simple, Success Made Possible

5. BiggerPockets Money

Financial Empowerment for a Dynamic World

To live a prosperous life people now a days, need to understand personal finance. Finance podcasts provides a detailed knowledge about money saving tips. Podcast are available on almost every topic from tips on money making to complete guidance on investments. These podcasts are available for people on a lot of platforms like Spotify, Apple Music and Stitcher.

Almost 300 to 400 million podcasts are available on internet. There are a lot of podcasts available on investment and finance. Based on various estimations, there are three to four million podcasts available globally. It is difficult to find best podcast from such a broad collection. So, in thus article we have discussed the top 5 next gen personal finance podcast.

Must Read:Top 5 Productivity Hacks For Professionals To Get Work Done

List of Top 5 Next Gen Personal Finance Podcasts

Here is the list of top 5 next gen personal finance Podcasts

1. The Money with Katie Show

Investment Expertise You Can Trust

Host:KatieGattiTassin

Total Episodes:224

Average episode Length:15 to 60 min

This podcast stands out for its unique combination of humor and depth. With her unique feminine perspective that's often absent from finance conversations, Katie tackles finance with an energy that's both refreshingly open and educational.

Translating difficult financial ideas into simple words is one of Gatti Tassin's best qualities. She uses relatable and simple language to convey financial issues. Her ability to translate financial terms into understandable language providesan interesting and instructive experience.

Gatti Tassin is wellaware of the difficulties faced by Youngsters. Every episode shows how much she understands the young people. Katie discusses a broad variety of financial subjects, many of which are relevant to her audience in some way.

She can help people with anything from investing to managing debt to creating wealth. Rich Girl Roundups and normal episodes are released two times a week on Mondays and Wednesdays, respectively. The programs consist of 15-minute wisdom advicesand hour-long in-depth conversations.

“Money with Katiewas founded in 2020 as a space for me, Katie Gatti Tassin, to document everything I was learning about personal finance on my journey to financial independence.”

Best For:It's ideal for young people, particularly women, who want to gain knowledgeof the financial world and become stronger.

Topics Covered:financial practices, smart investment choices, and tax planning

Listen On:Apple, Spotify

Best Episodes of The Money with Katie Show

- Building a Six-Figure Side Hustle & Budgeting with Variable Income

- How to Become a Millionaire in 10 Years

- Self-Care Culture is Making Us Broke, with Chelsea Fagan

- The Rent vs. Buy Decision in This Interest Rate Environment

- How to Prioritize Where You’re Investing, and Why

2. So Money

Elegant Solutions for Intelligent Investors

Host:Farnoosh Torabi

Total Episodes:1697

Average Episode Length:30 minutes

Farnoosh is a storyteller who gives money alive; she is more than just a financial expert. Her podcast covers a wide range of topics, including job advancement, family money, and personal finance. In her podcast, everyone can find what they need.

Farnoosh Torabi is a financial reporter, author, and television personality. Shegives listeners frank discussions on moneymanagement techniqueswith influential people and world-class business thinkers, including Margaret Cho, Seth Godin, and Arianna Huffington.

She also responds to listeners' financial queries on Ask Farnoosh on Fridays. On a specific financial issue, Torabi interacts with some of the brightest minds in business today, including influencers, writers, and professors.

So Money is Listed as a Top Podcast by MSNBC, Time Magazine, Real Simple, and The New York Times. Episodes are released three times a week on Mondays, Wednesdays and a question-answer session is on Friday.

“Candid conversations for a richer, happier life. Never miss a show! Join theSo Moneyonline community for early access, exclusive content, freebies, and download the free book.”

Best For:Listeners searching for motivation to get their finances in order by smart and fascinating chats with notable guests.

Topics Covered:Money strategies, growing, investing, and saving money and debt management

Listen On:Apple Podcasts, Spotify and Stitcher

Best Episodes of So Money

- Best of 2019: Stories of Financial Triumph

- Ask Farnoosh: What are some smart ways to earn passive income?

- Claudia Chan, Author of "This Is How We Rise"

- Balancing Act: Fintech Exec Alyssa Schaefer on Career, Family, and Financial Innovation

- Poverty, Drugs & Financial Trauma with J. Dana Trent, Author of Between Two Trailers

3. Planet Money

Elevating Your Wealth with Classy Investments

Hosts:Amanda Aronczyk, Erika Beras, Mary Childs, Nick Fountain, Sarah Gonzalez

Jeff Guo, Alexi Horowitz-Ghazi, Kenny Malone

Total Episodes:1135

Average episode Length:15–30 minutes

A number of speakers and experts are featured on the National Public Radio podcast "Planet Money" to clarify the state of the economy. In reaction to the 2008 financial crisis, the podcast was started with the goal of educating non-experts about the economic factors that caused the disaster.

These days, the 30-minute episodes of the podcast still discuss and explain the changing economy. Planet Money addresses well-known, complicated subjects like insider trading and American health carethrough simplified storytelling. The goal of the format is to make economic journalism accessible for readers who are not trained in economics but are curious about current economic concerns.

One of the most famous best personal finance podcasts and economics is Planet Money. It provides excellent responses to questions that frequently cross people's minds but are quickly forgotten. It reallyassists you in "understanding the world better" rather than just concentrating on gaining cash and making investments. Each episode lasts between 15 and 30 minutes and airs twice a week.

“SincePlanet Moneylaunched in 2008 during the financial crisis, it has won many awards including a Peabody and a couple Edward R. Murrow Awards, one for our investigation into Wells Fargo's retaliation against whistle-blowers and one for our "innovative" TikTok.”

Best For:Listeners interested in learning more about the present state of the economy.

Topics Covered:AP Economics, Economics concepts such as GDP, Supply, Demand etc.

Listen On:Spotify, Apple Music, Google Podcasts, Amazon Music

Best Episodes of Planet Money

- Why A Dead Shark Costs $12 Million

- How Four Drinking Buddies Saved Brazil

- Don’t Believe the Hype

- The Invention of ‘The Economy’

- When Women Stopped Coding

4. Money for the Rest of Us

Finance Made Simple, Success Made Possible

Hosts:David Stein

Total Episodes:488

Average Episode Length:25 to 30 minutes

In this personal finance podcast Money-related topics are covered by former chief financial analyst and money manager David Stein. He discusses how to live a worry-free life and how money operates. His goal is to impart simple financial management skills to those he speaks to.

Stein offers a business-minded understanding of how money functions and provides solutions to many of ourunanswered personal finance questions. These are questions that we may have been too embarrassed to ask. Usually, episodes last for thirty minutes.

In Short, this podcast focuses on money, how it functions, how to invest it, and how to live a worry-free life. To guarantee that listeners have enough money for retirement and that their assets continue to exist, host J. David Stein aims to help them become better, more self-assured investors.

For over eight years, he has used stories, analogies, and examples to help listeners learn how money, the economy, and finances interact. There are almost 488 episodes available. Fearless investment is the main topic of his podcast broadcasts. Every Wednesday, new episodes are made available.

“Money for the Rest of Usis a podcast about money, how it works, how to invest it, and how to live without worrying about it.”

Best For:Listeners seeking a thorough yet simple explanation of investment and personal finance.

Topics Covered:Retirement accounts, index investments, individual stock selection, financial planning, investing in stocks, and money management.

Listen On:Spotify, Apple Music

Best Episodes of Money for the Rest 0f Us

- Investing Won't Make You Rich

- How To Become Wealthy

- 10 Questions To Master Successful Investing

- Where Should You Invest Your Cash Savings?

- Was Tulipmania Just Like Bitcoin?

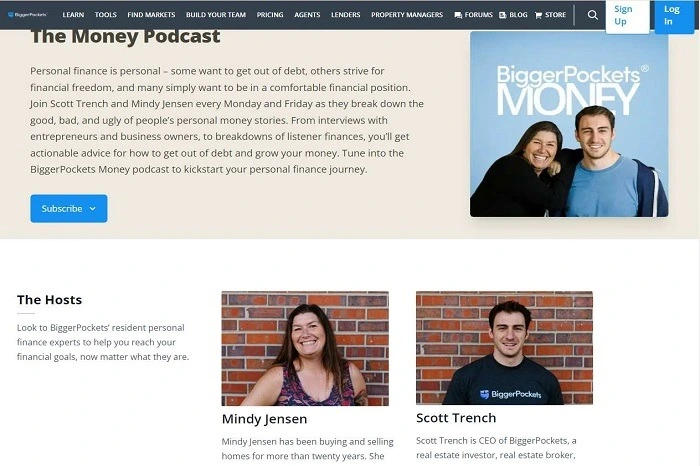

5. BiggerPockets Money

Financial Empowerment for a Dynamic World

Hosts:Scott Trench, Mindy Jensen

Total Episodes:558

Average Episode Length:60 to 90 minutes

It is one of the best finance podcasts with an emphasis on achieving financial independence. Every one-hour episode is filled with advice and professional insights on how to pay off debt, create a budget, and prepare for retirement. Within its ecosystem, BiggerPockets offers a number of podcasts on topics like investing, real estate, stock market, and investing for beginners.

Financial experts Scott Trench and Mindy Jensen speak with influential people about increasing wealth, increasing income, increasing savings, and reducing spending. BiggerPockets Money offers listeners practical guidance and suggestions on how to organize their finances through these talks.

Even when those who are wealthy wish they had more money, this show is a good option with more than 400 episodes. Those considering investing in real estate may find information in this podcast. BiggerPockets is a renowned resource for real estate guidance. Every Monday, new episodes of this podcast with over 60 minutes of financial advice are broadcast.

“Tune into theBiggerPockets Moneypodcast to kickstart your personal finance journey.”

Best For:Those who want to hear from experts on how to increase their wealth and make better financial decisions.

Topics Covered:personal finance, debt, taxes, investments, retirement accounts, retirement planning, money connections

Listen On:Spotify, Apple Music

Best Episodes of Biggerpockets Money

- How to Quit Your Job and Invest Full-Time with J Scott

- Building a $350 Million Real Estate Empire with Chris Clothier

- Buying a 115-Unit Apartment Complex for No Cash Out of Pocket with Brian Murray

- 15 Real Estate Investing Lessons Learned the Hard Way with David Greene

- How to Read Human Nature to Succeed in Life with Bestselling Author Robert Greene

The Advantages of Podcasts for Networking

Continuing Education and Professional Development:Podcasts about networking offer a practical means of staying informed about market trends, optimal procedures, and new technological advancements. Experts can provide you with insights that help improve your knowledge and abilities.

Different Viewpoints and Concepts:A large number of guests, including CEOs and freelancers, share their individual experiences and points of view on podcasts. Seeing things from different angles promotes original thought and increases creativity.

Networking Strategies and Advice:Podcasts about networking frequently cover useful advice for creating deep connections. These tips help up your networking game, from relationship-building strategies to powerfultalks.

Time Management and Adaptability:You can multitask while listening to podcasts. You can listen while working out, cleaning the house, or traveling. This adaptability guarantees that your hectic schedule won't be affected by your education.

Inspiration and Encouragement:Podcasts featuring success stories and personal tales can act as a source of motivation. Learning about others' successes inspires you to keep going.

Relationships and Community:Podcast hosts usually create a feeling of community by interacting with fans on social media or in person. Getting in touch with like-minded people helps to create a network of support.

Getting In Touch with Industry Leaders:Podcasts frequently include conversations with famous individuals. Hearing about their experiences, difficulties, and successes offers a unique chance to pick the brains of the greatest.

Elements of Personal Finance

The five elements of personal finance are protection, investing, saving, spending, and income.

- Income:The foundation of personal finance is income. It is the total amount of money people get that people can use for spending, saving, investing, and securing. All of your earnings are considered income. This covers income from payouts, salary, and other sources.

- Spending:The majority of earnings usually leave the house when it comes to spending. Whatever a person uses their salary to purchase is considered spending. Rent, mortgage, groceries, pastimes, eating out, home furnishings, house repairs, vacation, and entertainment fall under this category.

- Saving:The money left over after expenses are saved. Having money to meet major bills or unexpected expenses should be everyone's goal. That being said, it might be challenging to not spend your entire salary in this way.

- Investing:Buying assets typically stocks and bonds in order to generate a return on investment is known as investing. The goal of investing is to make a person wealthier than they started with. Since not all assets increase in value and can experience a loss, investing does carry some risk.

- Protection:The term "protection" describes the steps people take to safeguard their assets and shield themselves from unexpected events like sickness or accidents. Protection includes retirement and estate planning, as well as health and life insurance.

Frequently Asked Questions

Q. What's the Best Finance Learning Method?

Ans: A person can learn about money for free by a variety of media, including YouTube videos, podcasts, and books.

Q. What makes listening to podcasts on finance worthwhile?

Ans: You can improve your financial situation by listening to financial podcasts. They cover everything from getting rid of debt to increasing your money.

Q. Which five elements of personal finance are fundamental?

Ans: Income, Saving, Spending, Investing and Protection are the five fundamentals of personal finance.